Explore web search results related to this domain.

With a little preparation, budgeting and consistency, you’ll be well on your way to a financial life that aligns with your dreams and goals. When it comes to financial planning and guidance for key moments in your life, you don’t have to go it alone. Learn how we can help you develop a personalized financial plan. ... Investment ...

With a little preparation, budgeting and consistency, you’ll be well on your way to a financial life that aligns with your dreams and goals. When it comes to financial planning and guidance for key moments in your life, you don’t have to go it alone. Learn how we can help you develop a personalized financial plan. ... Investment and insurance products and services including annuities are: Not a deposit • Not FDIC insured • May lose value • Not bank guaranteed • Not insured by any federal government agency.Holding onto your investments through market highs and lows can be a good strategy, so remember to practice patience and stay informed. It’s important to regularly review your personal financial plan, as your goals and circumstances will change over time. Set an annual reminder and take some time each year, or when your circumstances change, to review your expenses, budget, financial accounts, estate planning documents and short- and long-term goals to make sure they’re still up to date and working well for you.Managing today's expenses while saving for the future takes planning and practice. Get on the right track with this five-step financial planning guide.Managing today's expenses while saving for the future takes preparation and practice. Get on the right track with this five-step financial planning guide.

Kevin Voigt is a freelance writer ... and investing topics for NerdWallet. He previously was a reporter with The Wall Street Journal and business producer for CNN.com in Hong Kong, where he was based for nearly two decades. See full bio. ... Raquel Tennant Certified Financial Planner® | financial planning, wealth management, high net worth, underserved communities, retirement planning · Raquel Tennant, CFP®, is a financial guide at Fruitful, ...

Kevin Voigt is a freelance writer covering personal loans and investing topics for NerdWallet. He previously was a reporter with The Wall Street Journal and business producer for CNN.com in Hong Kong, where he was based for nearly two decades. See full bio. ... Raquel Tennant Certified Financial Planner® | financial planning, wealth management, high net worth, underserved communities, retirement planning · Raquel Tennant, CFP®, is a financial guide at Fruitful, a financial wellness platform providing members with unlimited financial advice and access to financial planning to the masses at a low cost.I want complete financial planning and investment advice. I want specialized, face-to-face guidance.Financial planning means looking at your current financial situation, and finding strategies for how to reach long- and short-term goals.Reducing credit card or other high-interest debt is a common medium-term plan, and planning for retirement is a typical long-term plan. » Need help with this step? A step-by-step guide to budgeting · The bedrock of any financial plan is putting cash away for emergency expenses.

You start with basics like assessing ... estate planning. If you want to meld investment basics with tangible advice, this book is a great option. Read more: Our Best Investment Portfolio Examples for Savers and Retirees ... Advisor and The New York Times bestselling author Ramit Sethi outlines a six-week program for 20- to 35-year-olds to learn the four pillars of personal finance: banking, saving, budgeting, and ...

You start with basics like assessing your net worth and creating an organization system, and you progressively conquer more advanced topics including retirement investing, college savings, and estate planning. If you want to meld investment basics with tangible advice, this book is a great option. Read more: Our Best Investment Portfolio Examples for Savers and Retirees ... Advisor and The New York Times bestselling author Ramit Sethi outlines a six-week program for 20- to 35-year-olds to learn the four pillars of personal finance: banking, saving, budgeting, and investing.The Bogleheads are investing enthusiasts who honor Bogle and his advice, living by a philosophy to “emphasize starting early, living below one’s means, regular saving, broad diversification, simplicity, and sticking to one’s investment plan regardless of market conditions.” Members actively discuss financial news and theory in a forum. 3) Morningstar’s 30-Minute Money Solutions: A Step-by-Step Guide to Managing Your Finances, by Christine BenzWhy Moats Matter: The Morningstar Approach to Stock Investing, by Heather Brilliant and Elizabeth Collins · If you’re looking for a breakdown of the legendary Warren Buffett’s economic moat concept, this is the book for you. With this guide, you will learn how to find great companies at equally great prices, gain a better understanding of Morningstar’s approach, and more. ... This book looks at financial planning and decision-making from a psychological standpoint.These books cover everything a beginner needs, from the basics of personal finance and investing to how the markets influence our money decisions.

A financial plan can provide financial ... years toward financial well-being. Investment planning involves a thorough evaluation of your money situation including income, spending, debt, saving, and expectations for the future....

A financial plan can provide financial guidance so you're prepared to meet your obligations and objectives. It can also help you track your progress throughout the years toward financial well-being. Investment planning involves a thorough evaluation of your money situation including income, spending, debt, saving, and expectations for the future.Planning in finance starts with a calculation of one’s current net worth and cash flow. A solid investment plan provides guidance over time and serves as a way to track progress toward your goals.Whether you’re going it alone or with a financial planner, it's necessary to understand how important financial and investment plans can be to your financial future. They can provide the guidance that assures your financial success.It establishes important short- and long-term financial goals upon which you can base your investment planning. It clarifies the actions required to achieve your various financial goals. A financial plan can focus your attention on important immediate steps such as reducing debt and building your savings for emergencies. It enhances the probability that you'll achieve financial milestones and overall financial success. It can guide your efforts over time and provide a means to monitor your progress.

:max_bytes(150000):strip_icc()/financial_plan_final-e8e690fce7c7406fb4cc607e408681df.png)

Although it can seem daunting at first, once you create the family budget, tools and technology can help you put much of your plan on autopilot. Once you develop a financial safety net through your emergency fund and insurance products, manage debt, and start seeing your savings and investment ...

Although it can seem daunting at first, once you create the family budget, tools and technology can help you put much of your plan on autopilot. Once you develop a financial safety net through your emergency fund and insurance products, manage debt, and start seeing your savings and investment accounts grow, it can strengthen your family’s financial stability for not just today, but tomorrow as well.From investing in your children’s education to building long-term generational wealth, creating a family financial plan can help you feel secure in the financial future ahead. Use this guide to get there.Learn more about what family financial planning is, its main components, and some easy steps for getting started. Although a lot of households put together a family budget, many don’t take the next step of putting a plan into action, according to Taylor Kovar, certified financial planner (CFP), founder and chief executive officer (CEO) of Kovar Wealth Management, a Texas-based firm.You can choose a different percentage breakdown or try a different method altogether—and don’t be afraid to try more than one method until you find one that works best for your family. The key is giving your plan some guardrails. Why is a budget an essential tool for your family financial plan?

:max_bytes(150000):strip_icc()/HeroimageforSpotlight-v22-4f3516d38af249879d0c15a3ce1b0c86.png)

Creating a personal budget is the key to gaining control of your money. Follow these simple steps from Better Money Habits to begin creating your individual budget.

Consult with your own financial professional when making decisions regarding your financial or investment management. ©2024 Bank of America Corporation. We're here to help. Reach out by visiting our Contact page or schedule an appointment today. ... Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply. The Spending & Budgeting tool is currently available to clients with a personal checking or savings account, credit card, a linked Merrill investment account, as well as a Small Business checking or savings account.Most people need some way of seeing where their money is going each month. Budgeting can help you feel more in control of your finances and make it easier to save money for your goals. The trick is to figure out a way to track your finances that works for you. The following steps can help you create a budget plan.To be eligible for Bank of America Life Plan, a client must have a Bank of America consumer banking relationship (checking, savings, or credit card account) and be digitally active on the Bank of America website or mobile app. Merrill clients with a Merrill Edge Self-Directed, Merrill Edge Advisory, Merrill Guided Investing, or Merrill Guided Investing with Advisor account, who also have a Bank of America consumer banking relationship and are digitally active on the Bank of America website or mobile app, are also eligible; however, clients of Merrill Lynch Wealth Management or Bank of America Private Bank are not eligible, and should instead seek advice and guidance from their assigned advisor.Before you start sifting through the information you’ve tracked, make a list of your short- and long-term financial goals. Short-term goals should take one to three years to achieve and might include things like setting up an emergency fund or paying down credit card debt. Long-term goals, such as saving for retirement or your child’s college education, may take decades to reach. Many people wonder if they should focus on paying down debt, saving or investing.

Take the headache out of money management with these top budgeting apps.

Passionate about financial literacy and inclusion, she has a decade of experience as a freelance journalist covering policy, financial news, real estate and investing. A New Jersey native, she graduated with an M.A. in English Literature and Professional Writing from the University of Indianapolis, where she also worked as a graduate writing instructor. See full bio · Rocket Money · Best overall · See at Rocket Money View details · YNAB (You Need a Budget) Best for diving into the details · See at YNAB View details · PocketGuard · Best for debt pay-off planning ·Take the headache out of money management with these top budgeting apps. ... Liliana Hall is a writer for CNET Money covering banking, credit cards and mortgages. Previously, she wrote about personal credit for Bankrate and CreditCards.com. She is passionate about providing accessible content to enhance financial literacy.She has over 10 years of experience in personal finance and previously wrote for CBS MoneyWatch covering banking, investing, insurance and home equity products. She is passionate about arming consumers with the tools they need to take control of their financial lives.Courtney Johnston is a senior editor leading the CNET Money team. Passionate about financial literacy and inclusion, she has a decade of experience as a freelance journalist covering policy, financial news, real estate and investing. A New Jersey native, she graduated with an M.A.

We have a mix of free budgeting apps and ones that have premium plans with subscription fees, so you can choose an option based on your financial needs and priorities. Best overall for reducing spending and creating a budget ... Rocket Money is featured in our best budgeting apps guide.

Honeydue is featured in our best budgeting apps guide as the best option for couples. It's a great option if you don't want to pay a fee. It also allows you to have individual and shared finances. ... Monarch Money is an overall solid option if you prioritize creating monthly budgets and saving for individual savings goals. The main downside of the app is that it doesn't offer a free plan.Discover the best budgeting apps for January 2025. Our picks are free or have low subscription fees, as well as other standout features.Are you looking for ways to cut back on spending? Do you want a free plan or a subscription plan for your budgeting app? Do you want a detailed breakdown of your finances or more of a general overview? Do you want an app that helps you manage both your investment accounts and your bank accounts?Rocket Money (previously known as TrueBill) is our best budgeting app overall because it has a variety of tools to help you save and limit spending. Rocket Money has both a free plan and a premium plan. With the free plan, you'll be able to link bank accounts, credit cards, and investment accounts to track spending and you'll also be able to create a budget.

Now that we have answered these ... planning process i.e., getting a clear idea of what actually helps you reach your financial goals. There are seven key factors that can positively influence your finances in any given year, especially when there are budget cuts and downsizing affecting everyone one way or another, including successful executives. We often talk about things like low-cost investing and asset allocation but there are other big financial ideas that should guide your investment ...

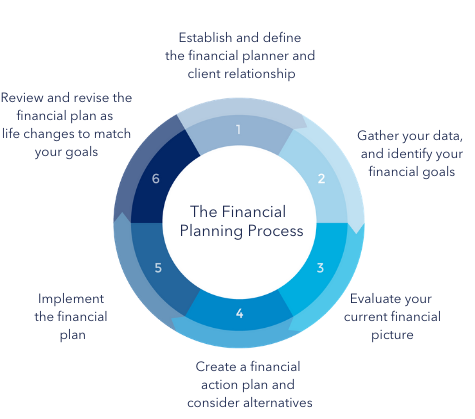

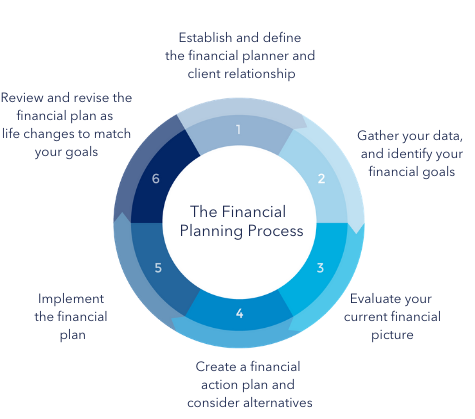

Now that we have answered these questions and put the doubts in your mind at ease, let's move on to the first part of your financial planning process i.e., getting a clear idea of what actually helps you reach your financial goals. There are seven key factors that can positively influence your finances in any given year, especially when there are budget cuts and downsizing affecting everyone one way or another, including successful executives. We often talk about things like low-cost investing and asset allocation but there are other big financial ideas that should guide your investment decisions too.Simply leaving it invested will produce extraordinary long-term results. As an international senior professional, comprehensive financial planning involves a few additional areas. · There are the 6 key considerations that go into comprehensive financial planning for expats and international executives like you: ... One of the best routes to strong budgeting - and ultimately to stress reduction - is to prepare a cash flow plan.An additional benefit is that many cash-flow forecasts created by professional financial planners will help you spot potential shortfalls or issues before they occur. If your plan anticipates future difficulties, such as not having enough to retire on, you’ll have plenty of warning to make alternative arrangements – like cutting spending and investing more today, so you can retire sooner and on a better income. A strong side benefit of having a solid cash flow plan is that you demonstrate effective budgeting - which may give others confidence in your financial management, thus potentially helping you secure loans, funding, mortgages or overdrafts.Financial planners can help prioritise the things that are most important to you and sift through the endless ambiguity on investing and insurance in order to find solutions that align to your unique goals. · It’s also about guiding you onto the right path and pulling you back when you veer off track, all while being an unbiased soundboard for any doubts or fears and reminding you to stay the course to achieve your long-term financial goals.

A financial planner can help you come up with specific financial strategies like how to budget, manage debt, and choose investments based on your specific situation. In contrast, if you're only reading advice online, that might not apply to your situation. It's easy to let emotion guide the way ...

A financial planner can help you come up with specific financial strategies like how to budget, manage debt, and choose investments based on your specific situation. In contrast, if you're only reading advice online, that might not apply to your situation. It's easy to let emotion guide the way with finances, but sometimes you need more objectivity.You can start financial planning on your own if you're comfortable setting financial goals and engaging in activities like budgeting and setting up a retirement account with automatic investments. However, if you're unsure how to create a financial plan or simply want additional guidance, you can reach out to a professional such as a financial planner, financial advisor, or financial consultant for help.Discover the key steps in financial planning, including budgeting, investing, and retirement planning. Build a road map for your financial future.See how we rate investing products to write unbiased product reviews. Financial planning is a practice that helps you track and manage your money with the purpose of reaching your financial goals. Create a strong financial plan by setting goals, tracking cash flow, budgeting, investing, and paying down debt.

Check your custom budgeting plan — anytime, anywhere! ... See where your money is going and discover places to save. ... Find subscriptions you don't use and start saving from day one. ... Why it stands out: Quicken Deluxe is a desktop software program. It's available for download for Mac and Windows computers. · With this top personal finance software for budgeting, you'll be able to connect and keep track of bank accounts, investment ...

Check your custom budgeting plan — anytime, anywhere! ... See where your money is going and discover places to save. ... Find subscriptions you don't use and start saving from day one. ... Why it stands out: Quicken Deluxe is a desktop software program. It's available for download for Mac and Windows computers. · With this top personal finance software for budgeting, you'll be able to connect and keep track of bank accounts, investment accounts, loans, and credit cards.You'll also be able to create a 12-month budget. Usually personal finance software programs only have monthly budget plans. Quicken Deluxe also has a "what-if" tool that lets you see potential scenarios when you make certain investments or loan decisions to help you build a financial plan.Personal finance software is a tool you can access on your computer or phone that might help you make a budget, set savings goals, track your investments, monitor your spending, or some combination of all four. It can help you with anything from retirement plans, investments, tax payments, or just general budget planning, such as building an emergency fund.Personal finance software is a tool you can access on your computer or phone that helps you keep track of and plan your finances. This can take the form of budget building and tracking, investment help, and more.

The software earns its annual ... budgeting, bills, and investing. Quicken Classic is best suited to personal finance power users who don’t mind setting up an application on their desktop and doing some of their work there. The software comes in three versions so a beginner might like the Deluxe edition, and people who need more in areas like planning, investing, ...

The software earns its annual subscription fee by supporting every element of personal finance, including detailed account management, budgeting, bills, and investing. Quicken Classic is best suited to personal finance power users who don’t mind setting up an application on their desktop and doing some of their work there. The software comes in three versions so a beginner might like the Deluxe edition, and people who need more in areas like planning, investing, and small business money management could use Quicken Classic Business & Personal.Empower is a great personal finance app for investment tracking and retirement planning. It has some unique investment tracking tools, including a personalized Investment Checkup, a withdrawal planner, and a retirement fee analyzer. It does try to sell you advisory services, though, but you may want them. It only has basic transaction management and budgeting tools, and there's nothing about your credit health.Need a replacement for Mint? Make sense of your budget, get a grasp on your household spending, or check your credit score with the best apps we've tested for managing your personal finances.The bill negotiation and subscription cancellation services may be especially helpful for people trying to reduce their monthly spending as part of a plan to get out of debt. And it's really good for people who want to track their money but don’t want to micromanage their finances or investments.

If you're a new investor interested in passive investing, an online robo-advisor is likely a good place to start. On the other hand, if you're looking for professional insight and a customized financial plan, you're better off with access to a human advisor through phone or video calls. · You can also meet with an expert in person for financial guidance...

Looking for personalized investment advice? Compare the best online financial advisors, robo-advisors, and platforms to meet your goals.For this list, we didn't consider online advisors that match clients and advisors for comprehensive financial planning services, such as Zoe Financial or Facet Wealth. Instead, we focused on tech-driven firms where you can access an automated and personalized portfolio and consult a professional for advice when needed. Here are our top picks for the best online financial advisors as picked by Business Insider editors in 2025. ... SoFi Automated Investing supports individual investment accounts, joint accounts, traditional IRAs, Roth IRAs, SEP IRAs, and 401(k) rollovers.Promotion: Fund your first taxable investment account with at least $500 in the first 30 days of account opening and earn a $50 bonus. ... A financial advisor is a catch-all term that includes financial planners and investment advisors.Robo-advisors typically offer low-cost ETFs as a cost-effective way to instantly diversify an investor's asset allocation and mitigate risk. Human Advisors (Virtual): Financial advisors that offer personalized financial planning and investment advice online through virtual meetings, email, and other virtual communication channels.

Many financial advisors who work at some of the best online brokerages adopt a holistic approach to personalized financial planning. This approach considers a person's entire financial situation when determining a budget, investment strategies, and debt consolidation.

Advisors help people navigate the complexities of retirement planning through tax-advantaged accounts and create a custom long-term plan and investment strategy. · While in retirement, a financial advisor ensures that the individual(s) don't run out of funds. This can include investing in fixed-income assets like bonds, purchasing an annuity, and establishing a realistic budget.While some advisors offer a wide range of services, many specialize only in making and managing investments. · A good advisor should be able to offer guidance on every aspect of your financial situation, though they may specialize in a certain area, like retirement planning or wealth management.Financial advisors offer various services, like portfolio building, estate planning, and budgeting. Do you plan to retire one day? Maybe get married or go to college? How about paying down some debt? These are all reasonable and attainable financial goals. For many of us, however, it's not always clear how to make these dreams come true. And that's why it might be a good idea to enlist some professional help. A financial advisor is a paid professional who provides insight and guidance to clients on various money-related topics.Learn how a financial advisor can help you achieve your goals. Discover the services they offer, from investment management to estate planning,

Planning and strategyPlanning and ... planning · Investing and retirement calculatorsRetirement calculator401(k) calculatorRoth IRA calculatorInvestment return calculatorSocial Security benefits calculator Small business ... Funding your businessSmall-business loansSBA loansBusiness lines of creditBusiness grantsStartup business loans · Managing business financesBusiness bank ...

Planning and strategyPlanning and strategyBest investments right nowEstate planningFinancial planning · Investing and retirement calculatorsRetirement calculator401(k) calculatorRoth IRA calculatorInvestment return calculatorSocial Security benefits calculator Small business ... Funding your businessSmall-business loansSBA loansBusiness lines of creditBusiness grantsStartup business loans · Managing business financesBusiness bank accountsBusiness credit cardsAccountingPayroll & HRBusiness taxesStep 1. Figure out your after-tax income Step 2. Choose a budgeting system Step 3. Track your progress Step 4. Automate your savings Step 5. Practice budget managementIf you find that the initial budgeting system you choose isn’t working for you, consider trying a different strategy. The budget you choose doesn’t have to last forever. ... NerdWallet Planning powered by Quinn can help you build a personalized plan to get rid of debt, save more of your paycheck, and invest in your future.The money you notice slipping through the cracks could go toward debt repayment, savings or another financial priority. Automate as much as possible so the money you’ve allocated for a specific purpose gets there with minimal effort on your part. If your employer permits, set up automatic payments from your paycheck to your emergency savings, investment and retirement accounts. An accountability partner or online support group can help, so that you're held accountable for choices that don't fit the budget.

The classes cover various topics, such as budgeting, investing, marriage and caregiving. Savvy Ladies also runs a free helpline, connecting you to a volunteer financial professional for one hour of free financial advice. Over 280 volunteers give guidance monthly on the helpline.

You can also take advantage of Bankrate’s free course on investing for beginners, in which we break down the different types of investment options available and how to build a smart portfolio. Or check out this course on budgeting for beginners instead. ... Quick citation guide Select a citation to automatically copy to clipboard. APA: Haegele, B. (2024, December 16). 8 ways to get free financial advice.There are many ways you can find low-cost or even free financial advice. These are not substitutes for personalized advice, however.A budgeting app like Rocket Money or PocketGuard can analyze your spending habits and offer recommendations based on your budgeting goals. Many budgeting and financial planning apps are available, and the companies that develop them want to attract new customers to create accounts with them.HUD-approved counselors can offer guidance on buying a home and rental housing services, foreclosure avoidance, credit issues and reverse mortgages. HUD partners with local nonprofit agencies to host seminars and workshops and meet with members of the public. To find a HUD-approved housing counseling service near you, use this HUD database. The FPA offers pro bono financial planning for underserved and at-risk communities.

With the right tools and resources, including tips on investing beyond your 401(k), you can map out a personalized financial plan from start-to-finish to help you succeed on all your financial goals . ... When it comes to life's biggest moments, you probably had a plan. Your family vacation, for example, followed a timeline, a budget...

With the right tools and resources, including tips on investing beyond your 401(k), you can map out a personalized financial plan from start-to-finish to help you succeed on all your financial goals . ... When it comes to life's biggest moments, you probably had a plan. Your family vacation, for example, followed a timeline, a budget—and some compromise and conversation.If you’re employed, you may have some sort of disability insurance through work, but it’s worth investigating how much it is, and if you can or want to purchase more. Check with your HR department; one key question to ask about is the elimination period, or how long you would wait to receive benefits if you do become disabled. And, a financial professional can help you determine if your coverage level is high enough to protect you and your family. As part of your financial plan, take time to dig into voluntary benefits if you have them, some of which may help your savings goals from getting derailed during big life events.And know that, like many people, your savings may ebb and flow as other goals come into view; that’s the whole point of revisiting your financial plan on a regular basis. Tool: Create your own custom retirement plan to help you take a more holistic approach to retirement. To reach your mid- and long-term goals, take your savings strategy and put an engine behind it. That’s what investing can do.To understand how to take a thoughtful, diversified approach—including regularly rebalancing your portfolio to account for market shifts and life stages—consult a financial professional. Tool: Learn the basics of broadening your investments with these three steps. In the simplest terms, an estate plan details who makes financial and health care decisions for you if you can’t make them yourself.

Financial Planning for Beginners: Financial planning is the process which provides you a framework for achieving your life goals in a systematic and planned way by avoiding shocks and surprises. Read on to find out the top 10 rules that help to plan your finances better.

When you don’t have a plan, you are likely to overspend. This money could have been used to make you financially self-sufficient. · In the backdrop of inflation, everything is going to be costlier with each passing year. If you don’t invest, your money won’t grow to bridge the inflation gap.These risks can lead to loss of income and put you and your dependents in a financial jeopardy. Similar to investing for wealth accumulation, ensure wealth preservation through insurance. · Buying a ULIP is not all. You end up paying more and remain inadequately insured. Instead of this, a term insurance plan will be a wiser proposition to buy.You are free to claim various tax exemptions, deductions, and benefits so as to reduce your tax liability at the end of the financial year. · Even though tax planning is very much legitimate in nature, you need to ensure that you don’t indulge in tax evasion or tax avoidance. There are a number of deductions available under Sections 80C through to 80U that are given in the Income Tax Act. · The most efficient way to take advantage of Section 80C is to invest in Equity Linked Savings Scheme (ELSS).Liquid fund is a type of debt mutual fund which invests money in fixed-income generating instruments like FDs, commercial paper, certificate of deposit etc. around 4%. Invest your savings every month over a long-term and see the magic it can do for you! If you are living paycheck to paycheck and finding yourself struggling for money even before the month ends, then chances are you are living way beyond your means. Maybe there are a lot of unplanned expenses! These might be leaving you with no money for the necessities. But there’s a way out of this. · Try preparing a budget.

Suzanne is a content marketer, writer, and fact-checker. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies. ... Saving vs. Investing: What Teens Should Know ... Credit Cards vs. Debit Cards ... A budget is a spending plan.

A budget is a personal spending plan that takes into account expected income and expenses for a specified period of time. It can bring you one step closer toward financial security. Having and sticking to a budget can keep your spending in check and assure that your savings for emergencies and longer-term goals, such as a comfortable retirement, stay consistent. ... Investopedia requires writers to use primary sources to support their work.Budgeting is a critical financial skill that is important for everyone, regardless of their level of financial knowledge. Learn how to budget, and the reasons why you should budget.An asset class is a grouping of investments that exhibit similar characteristics and are subject to the same laws and regulations. more · Financial Literacy: What It Is, and Why It Is So Important To Teach Teens · Financial literacy empowers teens to use financial skills, including personal financial management, budgeting, and investing, to better their financial futures.A budget uses information about what you spent last month to make a plan about what you'll spend this month. Having a budget keeps your spending in check and makes sure that your savings are on track for the future. Budgeting can help you set long-term financial goals, keep you from overspending, help shut down risky spending habits, and more.

It's important to build your own ... and guidelines. Elise shares moments from her own journey to show readers how they can adjust their mindset. ... A great book for beginners, "The Financial Diet" lays a groundwork for anyone wanting to learn more about money and life. Best for young adults, Fagan dives into starting to invest and saving for retirement, as well as budgeting and debt repayment plans...

It's important to build your own relationship with money rather than following set rules and guidelines. Elise shares moments from her own journey to show readers how they can adjust their mindset. ... A great book for beginners, "The Financial Diet" lays a groundwork for anyone wanting to learn more about money and life. Best for young adults, Fagan dives into starting to invest and saving for retirement, as well as budgeting and debt repayment plans.In "Finance for the People," former financial planner Paco de Leon explains how to take personal responsibility for our personal finances despite inequities out of our control, while providing the necessary tools to help you build a strong financial foundation. ... "Broke Millennial" took the world by storm with great budgeting tips written specifically for avocado-toast-brunching millennials. Erin Lowry is back at it again with a practical, easy-to-read guide to investing.Discover the best personal finance books to read in 2025. We have books about budgeting and investing so you can learn about personal finance.It takes on a light and casual tone in some chapters but doesn't shy away from explanations of more complicated topics, either, like the nuances of investing in a bear or bull market. It's the highest-rated personal finance book on the list, with over 3,800 Amazon reviews and an average rating of 4.8 stars. ... In "Financial Feminist," entrepreneur and author Tori Dunlap teaches women how to advocate for their worth and channel their emotions to make smart money decisions. Dunlap offers a financial game plan that helps you build a career you love.

:max_bytes(150000):strip_icc()/financial_plan_final-e8e690fce7c7406fb4cc607e408681df.png)

:max_bytes(150000):strip_icc()/HeroimageforSpotlight-v22-4f3516d38af249879d0c15a3ce1b0c86.png)