Explorez les résultats de recherche web liés à ce domaine.

The software earns its annual ... budgeting, bills, and investing. Quicken Classic is best suited to personal finance power users who don’t mind setting up an application on their desktop and doing some of their work there. The software comes in three versions so a beginner might like the Deluxe edition, and people who need more in areas like planning, investing, ...

The software earns its annual subscription fee by supporting every element of personal finance, including detailed account management, budgeting, bills, and investing. Quicken Classic is best suited to personal finance power users who don’t mind setting up an application on their desktop and doing some of their work there. The software comes in three versions so a beginner might like the Deluxe edition, and people who need more in areas like planning, investing, and small business money management could use Quicken Classic Business & Personal.Empower is a great personal finance app for investment tracking and retirement planning. It has some unique investment tracking tools, including a personalized Investment Checkup, a withdrawal planner, and a retirement fee analyzer. It does try to sell you advisory services, though, but you may want them. It only has basic transaction management and budgeting tools, and there's nothing about your credit health.Need a replacement for Mint? Make sense of your budget, get a grasp on your household spending, or check your credit score with the best apps we've tested for managing your personal finances.The bill negotiation and subscription cancellation services may be especially helpful for people trying to reduce their monthly spending as part of a plan to get out of debt. And it's really good for people who want to track their money but don’t want to micromanage their finances or investments.

Key questions can help you find ... and budget. ... Nov. 25, 2024 ... Nov. 25, 2024, at 4:19 p.m. ... Early planning often has the greatest impact on long-term financial success. ... Advisor's Corner is a collection of columns written by certified financial planners, financial advisors and experts for everyday investors like you.See ...

Key questions can help you find the right financial advisor that fits your goals and budget. ... Nov. 25, 2024 ... Nov. 25, 2024, at 4:19 p.m. ... Early planning often has the greatest impact on long-term financial success. ... Advisor's Corner is a collection of columns written by certified financial planners, financial advisors and experts for everyday investors like you.See MoreRelated: Sign up for stock news with our Invested newsletter. Whether you're navigating student loans after college, exploring financial independence through the FIRE movement, planning to launch a business with an inheritance, or tackling milestones like marriage or buying a home, professional guidance can be invaluable.As a smaller investor, your needs may differ from those of more affluent investors, but you still deserve the same high caliber of service. For example, smaller investors typically need an initial financial plan outlining goals, cash flow and investment recommendations. You may also require ongoing guidance for major milestones (e.g., buying a home, managing debt).National Association of Personal Financial Advisors (NAPFA). Garrett Planning Network. XY Planning Network (XYPN). These advisors specialize in next-generation investors.

Another typical responsibility ... new investment options. ... More progressive responsibilities of FP&A comprise preparing the budget and predicting the company’s coming financial performance. Budgeting demands analyzing financial reports to decide how to allot money. A smaller business may forecast four or eight months out, while a bigger enterprise could examine one to three years henceforward. Forecasting and planning are not only ...

Another typical responsibility of FP&A section members is evaluating a company’s investments with its working capital and discovering new investment options. ... More progressive responsibilities of FP&A comprise preparing the budget and predicting the company’s coming financial performance. Budgeting demands analyzing financial reports to decide how to allot money. A smaller business may forecast four or eight months out, while a bigger enterprise could examine one to three years henceforward. Forecasting and planning are not only a yearly or quarterly affair—more companies have turned to continual planning and rolling projections, regularly assessing the latest digits to make alterations.Read how Financial planning and Analysis equips executives with a projection of the company’s working performance for the future. Dig in.Financial planning and analysis (FP&A) specialists handle financial planning, budgeting, and forecasting procedures to advise chief decisions made by the board of directors and the administrative team of a business.Also, data from beyond the industry – such as more general demographic, financial, and market data – may also be gathered. After collecting all required data, it should be reduced, standardized, and confirmed. Precise plans, projections, budgets, and studies all rely on the rate and totality of the data they employ – so this stage is important.

Financial planners help individuals to reach their long term financial goals. From planning for retirement, to offering the structure and strategy needed to enable clients to make the most of their finances, financial planners advise on a range of issues including tax, investments, budgets and ...

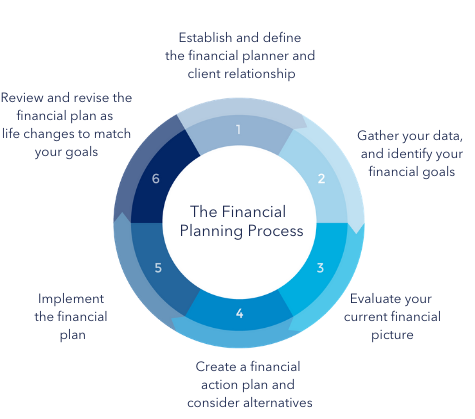

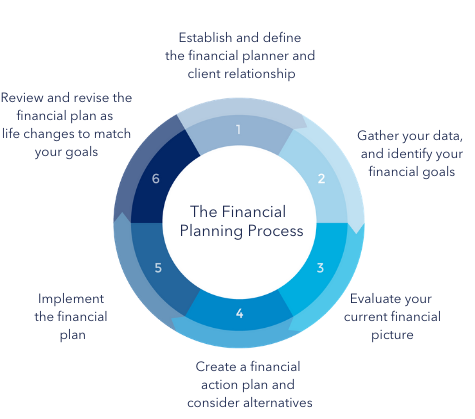

Financial planners help individuals to reach their long term financial goals. From planning for retirement, to offering the structure and strategy needed to enable clients to make the most of their finances, financial planners advise on a range of issues including tax, investments, budgets and inheritance.Estate planning, portfolio management, retirement options, and everyday money management (such as creating a realistic household budget) are additional tasks which may be required. · In terms of day-to-day activities, financial planners will also perform duties including: Keeping clients up to date with their investment portfolios.Interested in a financial planner career path? Here's all you need to know about it: roles, salaries, how to get in, progression, exit options etc.These careers can be quite rewarding, and there are numerous exit opportunities in the event that you wish to further your education or broaden your overall experience. If you’re considering financial planning, here’s everything you need to know about a financial planner career path. ... A financial advisor is a broader term encompassing finance professionals that help with money management and investments.

Creating a personal budget is the key to gaining control of your money. Follow these simple steps from Better Money Habits to begin creating your individual budget.

Consult with your own financial professional when making decisions regarding your financial or investment management. ©2024 Bank of America Corporation. We're here to help. Reach out by visiting our Contact page or schedule an appointment today. ... Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply. The Spending & Budgeting tool is currently available to clients with a personal checking or savings account, credit card, a linked Merrill investment account, as well as a Small Business checking or savings account.Most people need some way of seeing where their money is going each month. Budgeting can help you feel more in control of your finances and make it easier to save money for your goals. The trick is to figure out a way to track your finances that works for you. The following steps can help you create a budget plan.To be eligible for Bank of America Life Plan, a client must have a Bank of America consumer banking relationship (checking, savings, or credit card account) and be digitally active on the Bank of America website or mobile app. Merrill clients with a Merrill Edge Self-Directed, Merrill Edge Advisory, Merrill Guided Investing, or Merrill Guided Investing with Advisor account, who also have a Bank of America consumer banking relationship and are digitally active on the Bank of America website or mobile app, are also eligible; however, clients of Merrill Lynch Wealth Management or Bank of America Private Bank are not eligible, and should instead seek advice and guidance from their assigned advisor.Before you start sifting through the information you’ve tracked, make a list of your short- and long-term financial goals. Short-term goals should take one to three years to achieve and might include things like setting up an emergency fund or paying down credit card debt. Long-term goals, such as saving for retirement or your child’s college education, may take decades to reach. Many people wonder if they should focus on paying down debt, saving or investing.

Now that we have answered these ... planning process i.e., getting a clear idea of what actually helps you reach your financial goals. There are seven key factors that can positively influence your finances in any given year, especially when there are budget cuts and downsizing affecting everyone one way or another, including successful executives. We often talk about things like low-cost investing and asset allocation but there are other big financial ideas that should guide your investment ...

Now that we have answered these questions and put the doubts in your mind at ease, let's move on to the first part of your financial planning process i.e., getting a clear idea of what actually helps you reach your financial goals. There are seven key factors that can positively influence your finances in any given year, especially when there are budget cuts and downsizing affecting everyone one way or another, including successful executives. We often talk about things like low-cost investing and asset allocation but there are other big financial ideas that should guide your investment decisions too.Simply leaving it invested will produce extraordinary long-term results. As an international senior professional, comprehensive financial planning involves a few additional areas. · There are the 6 key considerations that go into comprehensive financial planning for expats and international executives like you: ... One of the best routes to strong budgeting - and ultimately to stress reduction - is to prepare a cash flow plan.An additional benefit is that many cash-flow forecasts created by professional financial planners will help you spot potential shortfalls or issues before they occur. If your plan anticipates future difficulties, such as not having enough to retire on, you’ll have plenty of warning to make alternative arrangements – like cutting spending and investing more today, so you can retire sooner and on a better income. A strong side benefit of having a solid cash flow plan is that you demonstrate effective budgeting - which may give others confidence in your financial management, thus potentially helping you secure loans, funding, mortgages or overdrafts.Financial planners can help prioritise the things that are most important to you and sift through the endless ambiguity on investing and insurance in order to find solutions that align to your unique goals. · It’s also about guiding you onto the right path and pulling you back when you veer off track, all while being an unbiased soundboard for any doubts or fears and reminding you to stay the course to achieve your long-term financial goals.

Planning and strategyPlanning and ... planning · Investing and retirement calculatorsRetirement calculator401(k) calculatorRoth IRA calculatorInvestment return calculatorSocial Security benefits calculator Small business ... Funding your businessSmall-business loansSBA loansBusiness lines of creditBusiness grantsStartup business loans · Managing business financesBusiness bank ...

Planning and strategyPlanning and strategyBest investments right nowEstate planningFinancial planning · Investing and retirement calculatorsRetirement calculator401(k) calculatorRoth IRA calculatorInvestment return calculatorSocial Security benefits calculator Small business ... Funding your businessSmall-business loansSBA loansBusiness lines of creditBusiness grantsStartup business loans · Managing business financesBusiness bank accountsBusiness credit cardsAccountingPayroll & HRBusiness taxesStep 1. Figure out your after-tax income Step 2. Choose a budgeting system Step 3. Track your progress Step 4. Automate your savings Step 5. Practice budget managementIf you find that the initial budgeting system you choose isn’t working for you, consider trying a different strategy. The budget you choose doesn’t have to last forever. ... NerdWallet Planning powered by Quinn can help you build a personalized plan to get rid of debt, save more of your paycheck, and invest in your future.The money you notice slipping through the cracks could go toward debt repayment, savings or another financial priority. Automate as much as possible so the money you’ve allocated for a specific purpose gets there with minimal effort on your part. If your employer permits, set up automatic payments from your paycheck to your emergency savings, investment and retirement accounts. An accountability partner or online support group can help, so that you're held accountable for choices that don't fit the budget.

The classes cover various topics, such as budgeting, investing, marriage and caregiving. Savvy Ladies also runs a free helpline, connecting you to a volunteer financial professional for one hour of free financial advice. Over 280 volunteers give guidance monthly on the helpline.

You can also take advantage of Bankrate’s free course on investing for beginners, in which we break down the different types of investment options available and how to build a smart portfolio. Or check out this course on budgeting for beginners instead. ... Quick citation guide Select a citation to automatically copy to clipboard. APA: Haegele, B. (2024, December 16). 8 ways to get free financial advice.There are many ways you can find low-cost or even free financial advice. These are not substitutes for personalized advice, however.A budgeting app like Rocket Money or PocketGuard can analyze your spending habits and offer recommendations based on your budgeting goals. Many budgeting and financial planning apps are available, and the companies that develop them want to attract new customers to create accounts with them.HUD-approved counselors can offer guidance on buying a home and rental housing services, foreclosure avoidance, credit issues and reverse mortgages. HUD partners with local nonprofit agencies to host seminars and workshops and meet with members of the public. To find a HUD-approved housing counseling service near you, use this HUD database. The FPA offers pro bono financial planning for underserved and at-risk communities.

Although it can seem daunting at first, once you create the family budget, tools and technology can help you put much of your plan on autopilot. Once you develop a financial safety net through your emergency fund and insurance products, manage debt, and start seeing your savings and investment ...

Although it can seem daunting at first, once you create the family budget, tools and technology can help you put much of your plan on autopilot. Once you develop a financial safety net through your emergency fund and insurance products, manage debt, and start seeing your savings and investment accounts grow, it can strengthen your family’s financial stability for not just today, but tomorrow as well.From investing in your children’s education to building long-term generational wealth, creating a family financial plan can help you feel secure in the financial future ahead. Use this guide to get there.Learn more about what family financial planning is, its main components, and some easy steps for getting started. Although a lot of households put together a family budget, many don’t take the next step of putting a plan into action, according to Taylor Kovar, certified financial planner (CFP), founder and chief executive officer (CEO) of Kovar Wealth Management, a Texas-based firm.You can choose a different percentage breakdown or try a different method altogether—and don’t be afraid to try more than one method until you find one that works best for your family. The key is giving your plan some guardrails. Why is a budget an essential tool for your family financial plan?

:max_bytes(150000):strip_icc()/HeroimageforSpotlight-v22-4f3516d38af249879d0c15a3ce1b0c86.png)

A financial plan can provide financial ... years toward financial well-being. Investment planning involves a thorough evaluation of your money situation including income, spending, debt, saving, and expectations for the future....

A financial plan can provide financial guidance so you're prepared to meet your obligations and objectives. It can also help you track your progress throughout the years toward financial well-being. Investment planning involves a thorough evaluation of your money situation including income, spending, debt, saving, and expectations for the future.Planning in finance starts with a calculation of one’s current net worth and cash flow. A solid investment plan provides guidance over time and serves as a way to track progress toward your goals.Whether you’re going it alone or with a financial planner, it's necessary to understand how important financial and investment plans can be to your financial future. They can provide the guidance that assures your financial success.It establishes important short- and long-term financial goals upon which you can base your investment planning. It clarifies the actions required to achieve your various financial goals. A financial plan can focus your attention on important immediate steps such as reducing debt and building your savings for emergencies. It enhances the probability that you'll achieve financial milestones and overall financial success. It can guide your efforts over time and provide a means to monitor your progress.

:max_bytes(150000):strip_icc()/financial_plan_final-e8e690fce7c7406fb4cc607e408681df.png)

With the right tools and resources, including tips on investing beyond your 401(k), you can map out a personalized financial plan from start-to-finish to help you succeed on all your financial goals . ... When it comes to life's biggest moments, you probably had a plan. Your family vacation, for example, followed a timeline, a budget...

With the right tools and resources, including tips on investing beyond your 401(k), you can map out a personalized financial plan from start-to-finish to help you succeed on all your financial goals . ... When it comes to life's biggest moments, you probably had a plan. Your family vacation, for example, followed a timeline, a budget—and some compromise and conversation.If you’re employed, you may have some sort of disability insurance through work, but it’s worth investigating how much it is, and if you can or want to purchase more. Check with your HR department; one key question to ask about is the elimination period, or how long you would wait to receive benefits if you do become disabled. And, a financial professional can help you determine if your coverage level is high enough to protect you and your family. As part of your financial plan, take time to dig into voluntary benefits if you have them, some of which may help your savings goals from getting derailed during big life events.And know that, like many people, your savings may ebb and flow as other goals come into view; that’s the whole point of revisiting your financial plan on a regular basis. Tool: Create your own custom retirement plan to help you take a more holistic approach to retirement. To reach your mid- and long-term goals, take your savings strategy and put an engine behind it. That’s what investing can do.To understand how to take a thoughtful, diversified approach—including regularly rebalancing your portfolio to account for market shifts and life stages—consult a financial professional. Tool: Learn the basics of broadening your investments with these three steps. In the simplest terms, an estate plan details who makes financial and health care decisions for you if you can’t make them yourself.

These professionals can help you ... increase investment returns, obtain risk-appropriate insurance, and more. · These professionals aren't one-size-fits-all, though, and finding the right one is critical to your success. Here's what you need to know about the best financial advisors and planners, and how to zero in on the best one for your goals and budget...

These professionals can help you achieve a wide range of short- and long-term goals — like having a comfortable retirement, funding your child's college tuition, or buying a house — along with potentially helping you save money on taxes, increase investment returns, obtain risk-appropriate insurance, and more. · These professionals aren't one-size-fits-all, though, and finding the right one is critical to your success. Here's what you need to know about the best financial advisors and planners, and how to zero in on the best one for your goals and budget.Robo-advisors typically won't help with budgeting, estate planning, tax planning, or other non-investment services. As Rob Burnette, an MRFC and chief executive officer of Outlook Financial Center in Troy, Ohio, explains, "Robo-advisors are only useful for the investment part of a financial plan."A financial advisor can help plan for retirement, build an investment portfolio, or budget to reach your financial goals.Find the right financial advisor for your needs with this comprehensive guide. Learn about credentials, fees, and questions to ask to make an informed decision.

Financial Planning for Beginners: Financial planning is the process which provides you a framework for achieving your life goals in a systematic and planned way by avoiding shocks and surprises. Read on to find out the top 10 rules that help to plan your finances better.

When you don’t have a plan, you are likely to overspend. This money could have been used to make you financially self-sufficient. · In the backdrop of inflation, everything is going to be costlier with each passing year. If you don’t invest, your money won’t grow to bridge the inflation gap.These risks can lead to loss of income and put you and your dependents in a financial jeopardy. Similar to investing for wealth accumulation, ensure wealth preservation through insurance. · Buying a ULIP is not all. You end up paying more and remain inadequately insured. Instead of this, a term insurance plan will be a wiser proposition to buy.You are free to claim various tax exemptions, deductions, and benefits so as to reduce your tax liability at the end of the financial year. · Even though tax planning is very much legitimate in nature, you need to ensure that you don’t indulge in tax evasion or tax avoidance. There are a number of deductions available under Sections 80C through to 80U that are given in the Income Tax Act. · The most efficient way to take advantage of Section 80C is to invest in Equity Linked Savings Scheme (ELSS).Liquid fund is a type of debt mutual fund which invests money in fixed-income generating instruments like FDs, commercial paper, certificate of deposit etc. around 4%. Invest your savings every month over a long-term and see the magic it can do for you! If you are living paycheck to paycheck and finding yourself struggling for money even before the month ends, then chances are you are living way beyond your means. Maybe there are a lot of unplanned expenses! These might be leaving you with no money for the necessities. But there’s a way out of this. · Try preparing a budget.

But when it comes to estate planning, this global lifestyle brings...Read more · Living as an expat can be an exciting adventure—new cultures, new opportunities, and sometimes, a whole new financial landscape. But when it comes to managing investments while living abroad, things...Read more

Budgeting might sound intimidating, but it’s actually a simple and powerful tool. We walk you through seven easy steps to start budgeting today.Consider putting this extra money towards savings, paying off debt, or investing. If your expenses are higher than your income, don’t worry. It just means you need to make adjustments. Start by cutting back on non-essential spending, like eating out or subscription services. The goal is to ensure your expenses don’t exceed your income. There’s no one-size-fits-all approach to budgeting. Choose a method that suits your lifestyle and financial goals.Holborn Assets is a leading international financial services with over 20,000 clients worldwide and in excess of $2billion AUM ... Budgeting might sound intimidating, but it’s actually a simple and powerful tool to take control of your money. Whether you’re saving for a dream holiday, tackling debt, or building a safety net, a budget helps you stay on track. Think of it as a map for your money—it shows you where it’s going and helps you decide where it should go. This guide will walk you through seven easy steps to start budgeting today.Review your budget monthly to ensure it still aligns with your goals. This regular check-in keeps you motivated and in control. Automate Your Savings: Set up automatic transfers to your savings account. Paying yourself first makes saving effortless. Build an Emergency Fund: Aim to save three to six months’ worth of essential expenses. This gives you a financial cushion for unexpected events.

Kevin Voigt is a freelance writer ... and investing topics for NerdWallet. He previously was a reporter with The Wall Street Journal and business producer for CNN.com in Hong Kong, where he was based for nearly two decades. See full bio. ... Raquel Tennant Certified Financial Planner® | financial planning, wealth management, high net worth, underserved communities, retirement planning · Raquel Tennant, CFP®, is a financial guide at Fruitful, ...

Kevin Voigt is a freelance writer covering personal loans and investing topics for NerdWallet. He previously was a reporter with The Wall Street Journal and business producer for CNN.com in Hong Kong, where he was based for nearly two decades. See full bio. ... Raquel Tennant Certified Financial Planner® | financial planning, wealth management, high net worth, underserved communities, retirement planning · Raquel Tennant, CFP®, is a financial guide at Fruitful, a financial wellness platform providing members with unlimited financial advice and access to financial planning to the masses at a low cost.I want complete financial planning and investment advice. I want specialized, face-to-face guidance.Financial planning means looking at your current financial situation, and finding strategies for how to reach long- and short-term goals.Reducing credit card or other high-interest debt is a common medium-term plan, and planning for retirement is a typical long-term plan. » Need help with this step? A step-by-step guide to budgeting · The bedrock of any financial plan is putting cash away for emergency expenses.

With a little preparation, budgeting and consistency, you’ll be well on your way to a financial life that aligns with your dreams and goals. When it comes to financial planning and guidance for key moments in your life, you don’t have to go it alone. Learn how we can help you develop a personalized financial plan. ... Investment ...

With a little preparation, budgeting and consistency, you’ll be well on your way to a financial life that aligns with your dreams and goals. When it comes to financial planning and guidance for key moments in your life, you don’t have to go it alone. Learn how we can help you develop a personalized financial plan. ... Investment and insurance products and services including annuities are: Not a deposit • Not FDIC insured • May lose value • Not bank guaranteed • Not insured by any federal government agency.Holding onto your investments through market highs and lows can be a good strategy, so remember to practice patience and stay informed. It’s important to regularly review your personal financial plan, as your goals and circumstances will change over time. Set an annual reminder and take some time each year, or when your circumstances change, to review your expenses, budget, financial accounts, estate planning documents and short- and long-term goals to make sure they’re still up to date and working well for you.Managing today's expenses while saving for the future takes planning and practice. Get on the right track with this five-step financial planning guide.Managing today's expenses while saving for the future takes preparation and practice. Get on the right track with this five-step financial planning guide.

It also has excellent advisory ... checkup, investment fee analyzer, financial planning, cash flow tracking, education cost planning and real-time net worth tracking. All of these tools give detailed insights into your current financial picture while helping you plan for the future. Getting started with the app is simple: All users need to do is link bank accounts, credit cards, student loans, mortgages and other line items from their budget...

It also has excellent advisory tools, including an investment checkup, investment fee analyzer, financial planning, cash flow tracking, education cost planning and real-time net worth tracking. All of these tools give detailed insights into your current financial picture while helping you plan for the future. Getting started with the app is simple: All users need to do is link bank accounts, credit cards, student loans, mortgages and other line items from their budget.Why We Like It We like that YNAB offers adjustable goal tracking—so you can customize your budget as your needs change—and reports to help you better understand your financial habits. YNAB also has a knowledgeable support team, guides to common questions and free online workshops. What We Don’t Like We don’t like that you can only use money already in your linked bank account to allocate funds to your budget with YNAB. You can’t plan ahead for your next paycheck, for example.Looking for the best budgeting apps? Doing more banking from your phone? Here are nine best budgeting apps to help you manage your personal finances.Looking for the best budgeting apps? Doing more banking from your phone? Here are the seven best budgeting apps to help you manage your personal finances.

An annual budget template is invaluable when planning for the entire year. Whether you’re setting aside funds for holidays, significant purchases, or unexpected expenses, this template provides a comprehensive overview of your financial landscape. It ensures you’re prepared for expected and unforeseen costs, preventing surprises. A budget allocation template allows you to prioritize and allocate funds across various categories such as savings, entertainment, utilities, and investments...

A simple yearly budget template provides a broad financial view over a year. It’s great for long-term financial planning, focusing on income, savings, and significant expenses. This template offers a detailed breakdown of your annual finances, tracking monthly expenses, savings, and investments.Businesses often use a budget plan sample for capital expenditures, as these costs are essential for long-term growth and investment planning. Understanding and including all relevant components in your budgeting template ensures your finances are well-managed.Discover 10 budgeting template for monthly financial planning using Excel and accounting software for efficient and effective financial management.A budgeting template is a pre-designed tool that helps individuals and businesses organize their financial planning. It serves as a structured guide, making it easier to track income, expenses, and savings goals without missing important details.

A financial planner can help you come up with specific financial strategies like how to budget, manage debt, and choose investments based on your specific situation. In contrast, if you're only reading advice online, that might not apply to your situation. It's easy to let emotion guide the way ...

A financial planner can help you come up with specific financial strategies like how to budget, manage debt, and choose investments based on your specific situation. In contrast, if you're only reading advice online, that might not apply to your situation. It's easy to let emotion guide the way with finances, but sometimes you need more objectivity.You can start financial planning on your own if you're comfortable setting financial goals and engaging in activities like budgeting and setting up a retirement account with automatic investments. However, if you're unsure how to create a financial plan or simply want additional guidance, you can reach out to a professional such as a financial planner, financial advisor, or financial consultant for help.Discover the key steps in financial planning, including budgeting, investing, and retirement planning. Build a road map for your financial future.See how we rate investing products to write unbiased product reviews. Financial planning is a practice that helps you track and manage your money with the purpose of reaching your financial goals. Create a strong financial plan by setting goals, tracking cash flow, budgeting, investing, and paying down debt.

Suzanne is a content marketer, writer, and fact-checker. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies. ... Saving vs. Investing: What Teens Should Know ... Credit Cards vs. Debit Cards ... A budget is a spending plan.

A budget is a personal spending plan that takes into account expected income and expenses for a specified period of time. It can bring you one step closer toward financial security. Having and sticking to a budget can keep your spending in check and assure that your savings for emergencies and longer-term goals, such as a comfortable retirement, stay consistent. ... Investopedia requires writers to use primary sources to support their work.Budgeting is a critical financial skill that is important for everyone, regardless of their level of financial knowledge. Learn how to budget, and the reasons why you should budget.An asset class is a grouping of investments that exhibit similar characteristics and are subject to the same laws and regulations. more · Financial Literacy: What It Is, and Why It Is So Important To Teach Teens · Financial literacy empowers teens to use financial skills, including personal financial management, budgeting, and investing, to better their financial futures.A budget uses information about what you spent last month to make a plan about what you'll spend this month. Having a budget keeps your spending in check and makes sure that your savings are on track for the future. Budgeting can help you set long-term financial goals, keep you from overspending, help shut down risky spending habits, and more.

:max_bytes(150000):strip_icc()/HeroimageforSpotlight-v22-4f3516d38af249879d0c15a3ce1b0c86.png)

:max_bytes(150000):strip_icc()/financial_plan_final-e8e690fce7c7406fb4cc607e408681df.png)